Are you interested in reducing your car insurance rates while keeping full coverage?

Car insurance represents a required expense which may significantly reduce your monthly budget allotment.

The good news?

You have the power to negotiate better rates instead of accepting the initial insurance quote. You can implement several successful methods to minimize your expenses while preserving required coverage.

What You’ll Discover:

- Understanding Your Car Insurance Policy

- Smart Shopping Strategies

- Discounts You Might Be Missing

- Lifestyle Changes That Lower Premiums

- Technology That Saves You Money

Understanding Your Car Insurance Policy

You must understand your car insurance costs before you can start saving money on them.

Most drivers don’t realize that comprehensive car insurance includes several coverage components that can be adjusted independently.

But what exactly does your policy cover? A typical comprehensive policy includes:

- Third-party liability: Covers damage you cause to others

- Collision coverage: Pays for damage to your car from accidents

- Comprehensive coverage: Protects against theft, vandalism, and weather damage

- Personal injury protection: Covers medical expenses

- Uninsured/underinsured motorist: Protection from drivers without adequate insurance

Many people fail to realize you can maintain different coverage levels for each type of protection. You have your first chance to save money by tailoring your coverage levels to meet your unique needs.

If your older vehicle has lost much of its value you should weigh the benefits of removing collision coverage. Is it worth spending £200 each year for insurance on a vehicle valued at just £1,000?

Many drivers fail to consider how adjusting their excess (deductible) amount could bring down their insurance costs. If you increase your excess from £250 to £500 it can reduce your insurance premium by 10-15%. Ensure you can afford the increased excess amount because it becomes payable when you make a claim.

Smart Shopping Strategies

Since insurers spend heavily to gain your business because they compete intensely for your attention – make them work for your favor!

Always compare multiple quotes before accepting your insurance renewal offer. Insurance companies exploit customer inertia by offering their most competitive rates to new clients.

Here’s how to outsmart them:

- Evaluate multiple insurance options by checking quotes from at least three to five different providers on comparison websites and directly from insurers.

- Certain insurance companies focus exclusively on specific demographic groups.

- Contact your current insurance provider to inform them about the superior rates found from other insurers.

- Adjust your insurance policy every year because your requirements evolve as time passes.

Did you know? Insurance shopping should occur between 21 and 25 days prior to your renewal date. Insurance companies charge higher prices for last-minute purchases because they consider such behavior risky.

Discounts You Might Be Missing

Many drivers remain unaware of multiple insurance discounts or they fail to request them. In 2024 car insurance claim payouts reached a record £11.7 billion which represented a 17% growth from the year before. Insurers now have stronger incentives to reward driving behaviors that lower their risk exposure.

Common discounts include:

- Combine your home and auto insurance policies to receive savings of 5-25%.

- Insuring multiple vehicles with the same provider can lead to savings between 10-25%.

- Certain companies continue to offer loyalty rewards to customers who stay with them for an extended period.

- Professional organizations often receive special insurance rates from many insurers.

- If you drive fewer than 7,500 miles annually you may receive a low mileage discount. You could save 10-15%

- Installing alarms and immobilizers along with tracking devices helps lower insurance premiums.

- Paying your insurance premium in full annually can provide savings of 10% compared to monthly payments.

The most overlooked discount? Advanced driving courses from insurers provide significant premium reductions for drivers who complete them. Taking advanced driving courses helps you drive safely while offering up to a 10% reduction in your premium.

The cost of your insurance policy is significantly influenced by details about your own personal situation. You have no influence over certain factors such as your age but you can modify many other variables.

Your Vehicle Choice Matters

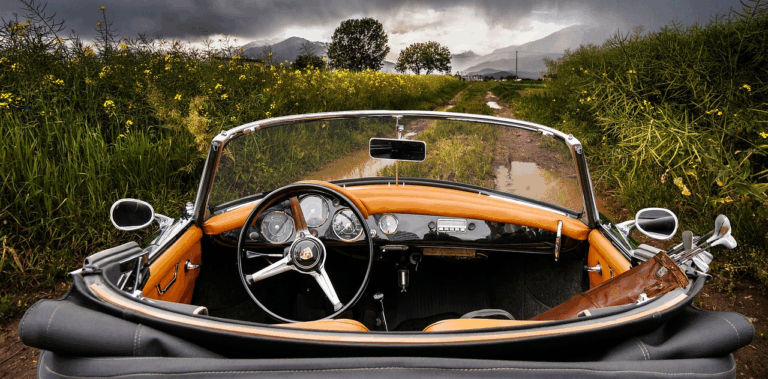

Driving a high-performance sports car? Expect to pay premium rates. Insurance companies classify vehicles into rating groups that range from 1 as the cheapest to insure to 50 as the most costly.

Research its insurance rating before purchasing your next vehicle. The annual premium cost difference between a Group 10 car and a Group 30 car runs into hundreds of pounds.

What makes a car cheaper to insure?

- Lower risk arises from smaller engine sizes because they produce less power.

- Repairs become more cost-effective when spare parts are widely available for common models.

- Vehicles that achieve high Euro NCAP safety ratings earn strong safety ratings.

- Low theft rates result in cars that thieves ignore.

Clean Up Your Driving Record

Risk assessment determines insurance rates while your driving history provides crucial information about your risk. Insurance premiums can rise by 25% or above when points appear on your driving record.

The good news? Most points expire after 3-5 years. Maintain a clean driving record following a spotty history to experience a gradual reduction in insurance premiums.

Technology That Saves You Money

Advancements in technology are reshaping car insurance which enables cost savings alongside improved protection.

Telematics and Black Box Insurance

Telematics insurance policies employ a compact monitoring device known as a black box to track your driving patterns. Insurers can determine your premiums by analyzing your real driving behavior instead of using population statistics and demographic data.

- Statistical analysis shows that late-night driving presents higher risks.

- Insurers analyze your vehicle’s acceleration patterns as well as your braking behavior and cornering techniques.

- Accident rates vary between different areas.

- Driving fewer miles typically results in decreased risk.

Young drivers could save up to 30% on their premiums through telematics compared to conventional insurance policies.

Dashcams for Evidence and Discounts

Dashcams record video footage during accidents which can be used to settle disputes and guard you against fake claims. Drivers who install dashcams can receive insurance discounts between 10% and 15% from certain insurers.

A dashcam costing £50-100 provides peace of mind while offsetting its price through insurance premium savings.

Not every incident warrants making a claim. Repairing small scratches and minor damage yourself can save you money compared to the potential loss of your no-claims bonus.

Your premium may decrease by as much as 80% after maintaining no claims for five consecutive years. Submitting a small claim will eliminate your discount which can result in hundreds of pounds more in charges during subsequent years.

Final Money-Saving Tips

Here are several quick-win tips that will help you save money immediately before we finish.

- Your occupation description can influence premium costs through minor variations.

- Including a skilled secondary driver in your policy can bring down insurance expenses.

- Whenever you are able to pay the full amount upfront you will avoid the additional interest charges that come with monthly payment plans

- Avoid stating higher mileage figures than your actual driving habits.

- Evaluate whether you actually require the courtesy car coverage option.

- Establish a reminder 3-4 weeks prior to your policy renewal date.

Wrapping It All Up

You can obtain car insurance without spending a lot of money. You can lower your premiums without reducing coverage by understanding your policy, making smart shopping choices and seeking discounts, adjusting your lifestyle and using technology.

The UK motor insurance market maintains a competitive edge while undergoing continuous change. By applying several of these strategies right away you will likely experience significant cost reductions when you renew your policy. Put your saved premium money toward things that bring you greater enjoyment and satisfaction.