Imagine waking up and seeing the world clearly without fumbling for your glasses or wrestling with contact lenses. For many, LASIK eye surgery is the golden ticket to a life unchained from blurry vision. But before diving into this life-changing procedure, it’s natural to wonder: just how successful is LASIK?

LASIK Eye Surgery Success Rate

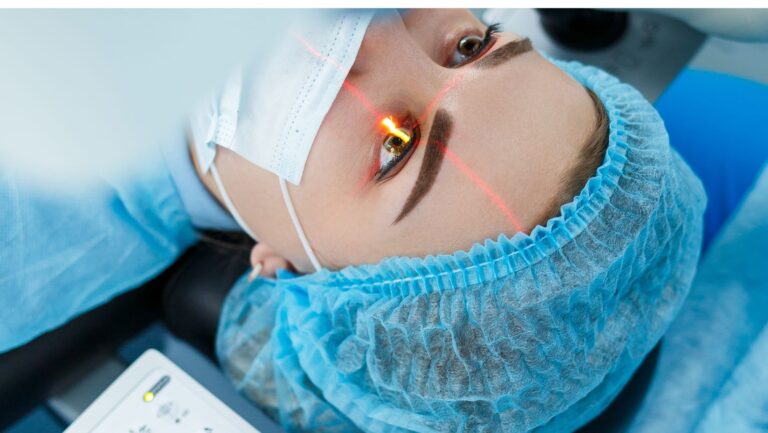

LASIK eye surgery, or Laser-Assisted In Situ Keratomileusis, offers a popular method for correcting vision. This outpatient procedure reshapes the cornea using a precise laser. Many people seek LASIK to reduce reliance on corrective eyewear.

Before starting, a thorough eye examination assesses the patient’s candidacy. During the surgery, the ophthalmologist creates a thin flap in the cornea, allowing access to the underlying tissue. The laser then reshapes the cornea, resulting in improved vision.

Recovery typically occurs rapidly, often within a few days. Patients frequently notice significant vision improvements immediately or shortly after surgery. Statistics indicate that around 96% of LASIK patients achieve 20/25 vision or better. This success rate reflects the procedure’s effectiveness in addressing common refractive errors such as myopia, hyperopia, and astigmatism.

Potential candidates should discuss risks, benefits, and expected outcomes with their eye care professional. While LASIK boasts a high success rate, individual results may vary based on factors like overall eye health and the severity of vision impairment. These considerations play a crucial role in determining realistic expectations.

Overall, LASIK eye surgery represents a significant advancement in vision correction, with many patients experiencing positive outcomes. The combination of modern technology and experienced surgeons contributes to the procedure’s remarkable success in enhancing vision and quality of life.

Factors Influencing Success Rate

Several elements play a crucial role in determining the success rate of LASIK eye surgery. Understanding these factors helps patients set realistic expectations.

Patient Eligibility

Patient eligibility greatly affects LASIK outcomes. Candidates must meet specific criteria, such as age, refractive error, and overall eye health. Generally, individuals over 18 years old are preferred. Stable vision for at least one year before surgery indicates good candidacy. Certain medical conditions, like autoimmune diseases or severe dry eye, may disqualify potential patients. Moreover, corneal thickness is essential; insufficient thickness can lead to complications. Eye care professionals assess these factors thoroughly during pre-operative evaluations.

Surgeon Experience

Surgeon experience significantly influences the success rate of LASIK procedures. Practitioners with extensive training and a high volume of surgeries typically achieve better outcomes. Experienced surgeons are familiar with potential complications and advanced techniques. They tailor surgeries to fit individual eye characteristics. Surgery executed by an adept professional can lead to fewer side effects and quicker recovery. Studies indicate that surgeon skill correlates with patient satisfaction. It’s advisable for candidates to consider a surgeon’s credentials and track record before proceeding with LASIK.

Success Rate Statistics

LASIK eye surgery boasts impressive statistics regarding its success rates. With approximately 96% of patients achieving 20/25 vision or better, this procedure effectively addresses refractive errors such as myopia, hyperopia, and astigmatism.

General Success Rates

General success rates for LASIK eye surgery remain notable. Various studies indicate that most patients experience significant improvement soon after the procedure. For instance, 90% of patients reach their desired vision within a few days. Additionally, the percentage of patients who express satisfaction with their vision post-surgery exceeds 95%. Many individuals no longer require corrective lenses after the procedure, highlighting LASIK’s effectiveness.

Long-Term Outcomes

Long-term outcomes demonstrate the durability of LASIK’s results. Research shows that about 90% of LASIK patients maintain 20/40 vision or better for five years after surgery. Some studies indicate that over 85% of patients report stable vision for more than ten years. Enhanced visual acuity and reduced reliance on corrective eyewear exemplify LASIK’s lasting benefits.

Potential Risks and Complications

Lasik eye surgery carries potential risks despite its high success rate. Understanding these potential risks helps patients make informed decisions.

Common Side Effects

Some patients experience common side effects after Lasik surgery. These side effects include dry eyes, glare, halos, and fluctuating vision. Dry eyes occur in about 20% of patients and typically resolve within a few months. Visual disturbances like glare and halos may affect nighttime vision but often diminish over time. Fluctuating vision usually stabilizes within a few weeks. Most side effects are temporary and manageable, but monitoring symptoms is essential for optimal recovery.

Rare Complications

Rare complications can arise during or after the Lasik procedure. While infrequent, some patients may face issues like corneal scarring, infection, or vision loss. Corneal scarring can result from improper healing and affects a small percentage of patients. Infection, though rare, occurs in about 1 in 1,000 cases, necessitating prompt treatment. Vision loss is extremely rare, affecting fewer than 1 in 10,000 patients. Awareness of these risks helps candidates weigh the benefits against the potential complications of Lasik eye surgery.

LASIK eye surgery stands out as a highly effective option for those looking to improve their vision. With a remarkable success rate and a significant percentage of patients achieving their desired outcomes, it’s no wonder many are turning to this procedure.

While potential risks exist, they are often temporary and manageable. The importance of choosing a qualified surgeon cannot be overstated as their expertise can greatly influence the overall experience and results.

For those considering LASIK, understanding both the benefits and risks is crucial. With the right information and professional guidance, many can enjoy clearer vision and a more convenient lifestyle.

The gameplay revolves around forming winning combinations, requiring sharp thinking and calculated moves.

The gameplay revolves around forming winning combinations, requiring sharp thinking and calculated moves.