Exchanging cryptocurrency for fiat currency is an essential process for cryptocurrency users. As digital assets become increasingly integrated into everyday financial transactions, the ability to seamlessly convert these assets into traditional currency ensures liquidity and usability. Understanding and efficiently managing this exchange process is key to maximizing the practical benefits of your digital holdings.

Virtual USDT cards are specialized digital payment solutions that facilitate the conversion of USDT (Tether) into fiat currency. These cards operate similarly to conventional virtual cards but are specifically designed to handle cryptocurrency transactions. Technically, they integrate with blockchain networks to securely store and transfer USDT while providing a bridge to traditional banking systems for fiat currency transactions. The primary distinction between virtual USDT cards and other virtual cards lies in their ability to directly process and convert cryptocurrency. In 2024, these cards have become highly sought after due to their enhanced security features, real-time transaction capabilities, and broad acceptance across global financial networks.

How Do You Exchange USDT for Fiat with a Crypto Virtual Card?

To exchange USDT for fiat using a virtual card, you need to follow several steps. First, load your virtual USDT card with the desired amount of USDT. The card provider will then facilitate the conversion of USDT to the selected fiat currency, typically using real-time exchange rates. This converted amount is then available for spending or withdrawal through traditional payment networks like Visa or Mastercard.

Let’s examine this process using PSTNET, a service offering various virtual crypto cards, including the Ultima card. Through the Ultima card, you can convert USDT to USD efficiently, leveraging the card’s integration with multiple financial systems to ensure seamless and secure transactions.

What Is PSTNET?

PSTNET is a service that offers a wide range of virtual cards tailored to various needs. These cards can be used for shopping, paying for digital products, and even media buying. The service has received excellent user reviews, with the Ultima card being particularly valued for its versatility. The Virtual USDT card from PSTNET is among the most popular choices due to its broad applicability and user-friendly features.

All cards offered by PSTNET are cryptocurrency-based, enabling you to convert your crypto into fiat currency effortlessly. With support for 18 different cryptocurrencies, including BTC, USDT (TRC 20, ERC 20), ETH, BNB, XRP, TRX, BCH, USDC (Ethereum), USDC (Tron), ADA, SOL, MATIC, BUSD, LTC, DASH, DOGE, and TON USDT, these cards make it easy to use your digital assets in everyday transactions.

The issuing banks for these cards are located in Europe and the United States, and financial operations are conducted through Visa and Mastercard payment systems. This global reach means you can use PSTNET virtual cards anywhere that accepts Visa or Mastercards. For businesses, PSTNET offers the ability to create branded digital products through White Label Cards. This feature allows brands to design custom cards tailored to their specific needs, enhancing their financial services offerings. PSTNET offers a universal solution for everyday users with the Ultima card. It is ideal for online shopping, paying for digital subscriptions and products, booking hotels, and purchasing airline tickets.

What Are the Benefits of PSTNET?

- All PSTNET cards come with no fees for transactions, withdrawals, or declined operations.

- Top-up fees start at 2%, regardless of the method used

- Transaction security is ensured by 3D Secure protection technology. Users receive a 3DS code via SMS or a confidential Telegram bot

- Two-factor authentication further safeguards user data

- You can issue an unlimited number of cards with PSTNET

- With simple withdrawal options, you won’t incur additional costs when accessing your funds.

- Customer support is available 24/7, with managers ready to assist you via Telegram, WhatsApp, and email.

How Can I Convert USDT to USD with the Ultima Card?

Virtual crypto cards offer the simplest way to convert USDT into fiat. Let’s break down the process using the Ultima card in just three steps.

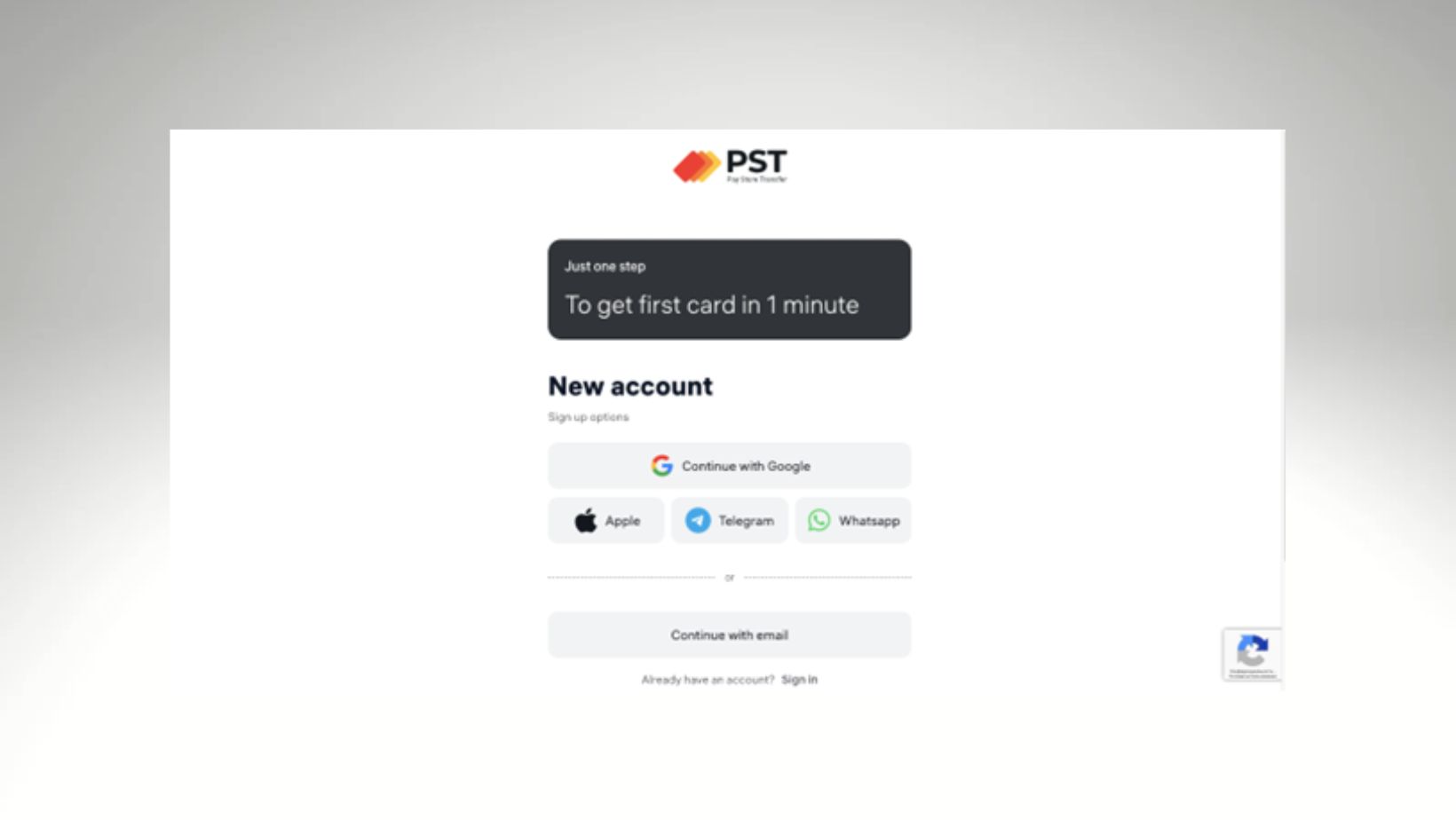

Step 1: Register on the Platform and Issue the Card

You can use a Google, Telegram, WhatsApp, or email account to register. This takes no more than a minute and is available to anyone with internet access. After registration, you can issue a card in your user account by clicking the “Get card” button.

Note that verification is required for cryptocurrency transactions to comply with regulatory standards and ensure security.

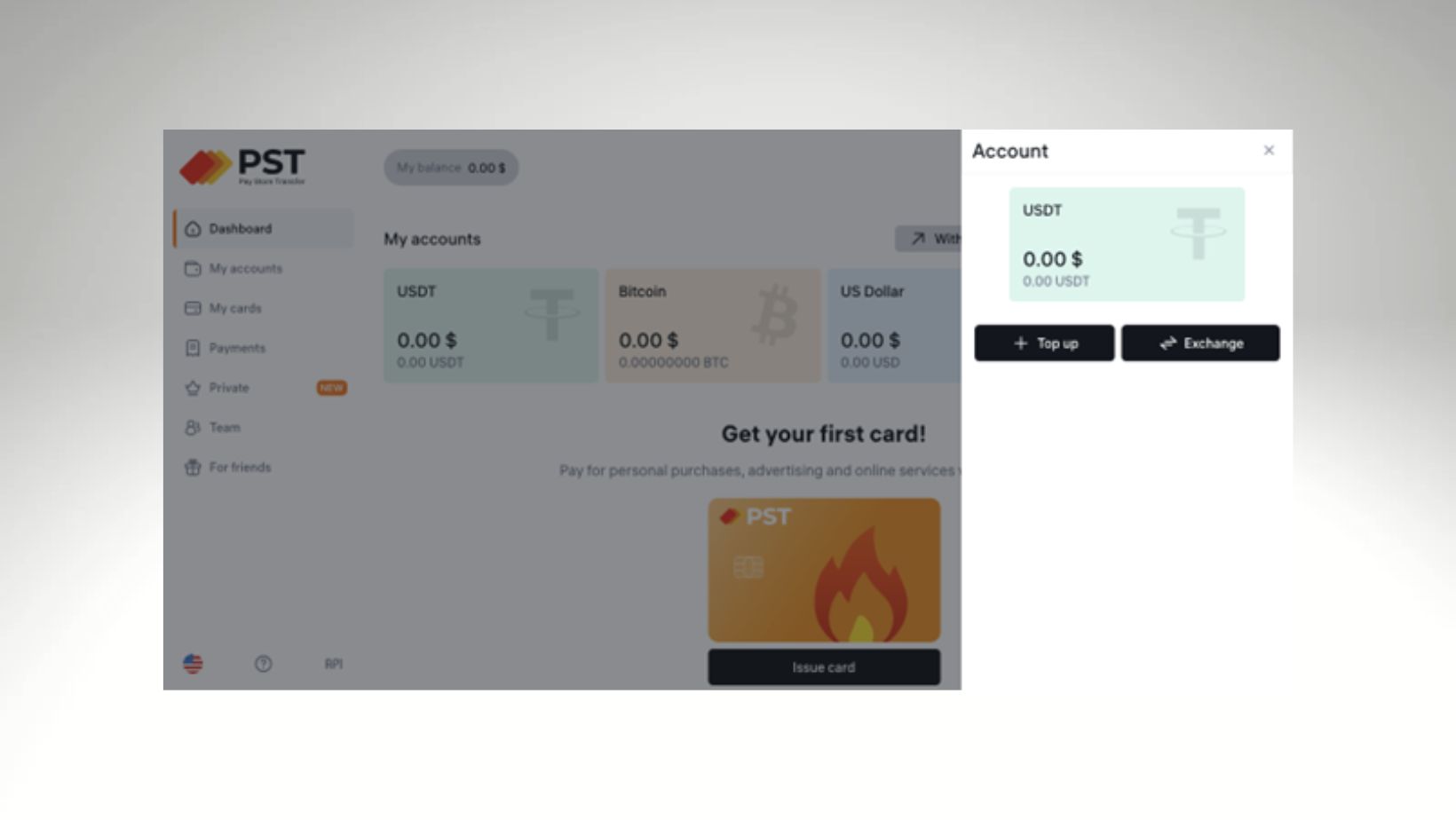

Step 2: Top Up the Card

Click “Top Up Account.” The Ultima cards can be topped up in various ways, including SWIFT/SEPA bank transfers, Visa/Mastercard, and 18 cryptocurrencies.

In this case, select USDT to top up the card and scan the QR code of the crypto wallet address.

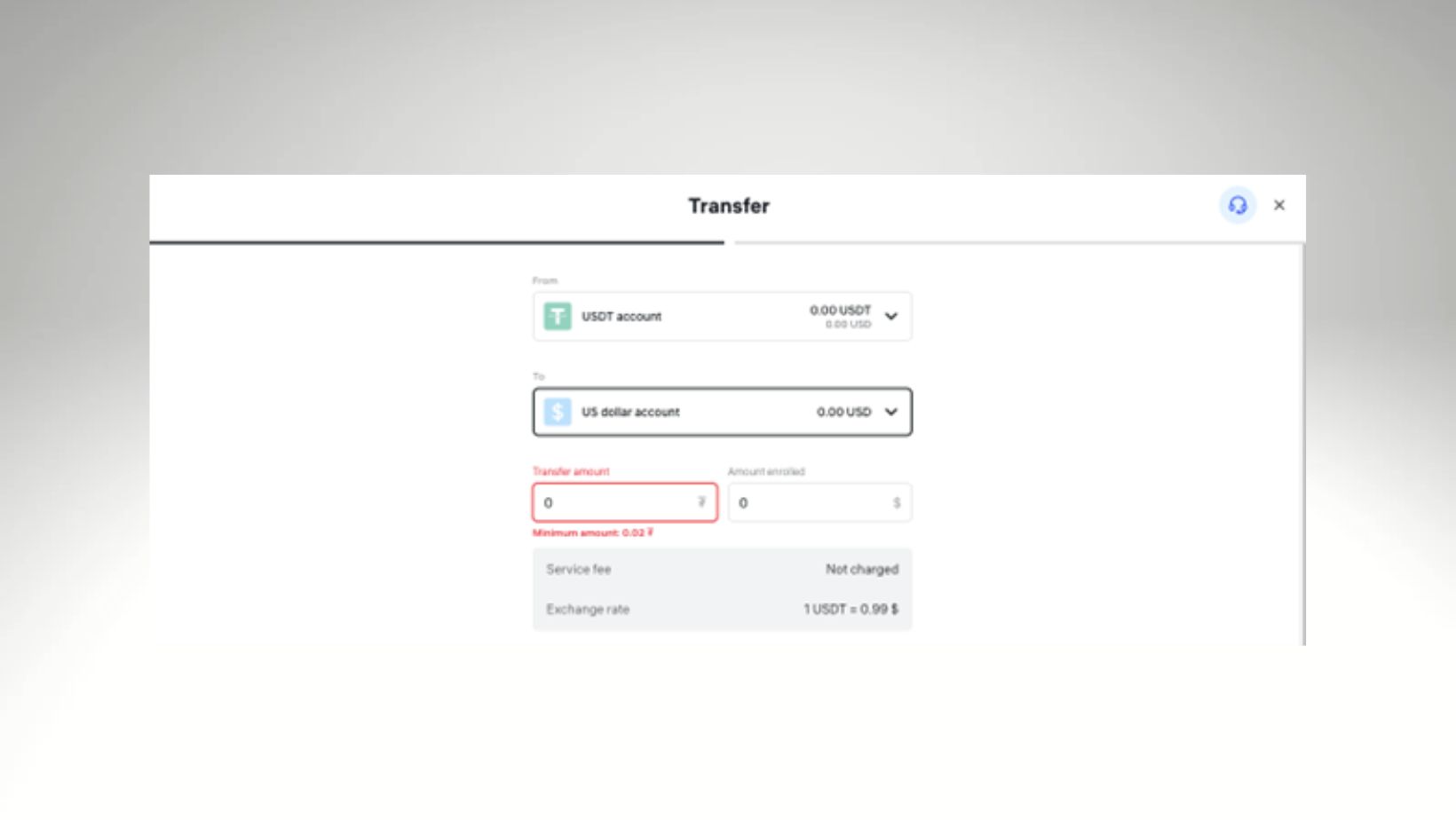

Step 3: Convert USDT to fiat

Once your funds are credited, you will immediately see them in your user account under the USDT balance. To convert them to USD, click on “Exchange.” In the window that opens, select USD as the fiat currency and specify the amount of USDT you want to convert.

Done! The funds are automatically credited to your USD account.

What Other Platforms and Services Offer USDT to Fiat Conversion?

In addition to PSTNET, several other platforms provide services for converting USDT to fiat currencies. When choosing a conversion method, it is important to consider various criteria: conversion fees, security level, transaction speed, geographical availability, and the platform’s reputation.

Bybit

Bybit is a well-known cryptocurrency exchange that offers USDT to fiat conversion services. According to Bybit’s website, the fee for converting USDT to fiat is 0.1%. The platform ensures security through multi-level protection systems, including two-factor authentication (2FA) and cold storage of assets.

Transactions are typically processed quickly, depending on network congestion. Bybit is available in many countries, though regional restrictions should be checked before registering. The platform has a good reputation among users thanks to its high-security standards and transparent fee structure.

Capitalist

Capitalist provides a wide range of financial services, including cryptocurrency conversion. According to the information on the Capitalist website, the fee for converting USDT to fiat is starting at 2%. The platform offers a high level of security, utilizing advanced encryption and authentication technologies. Transactions are executed quickly, often within a few minutes. Capitalism is broadly available to users in most countries. The platform also enjoys a positive reputation for offering competitive conditions and a high level of security.

Nexo

Nexo is a platform for managing cryptocurrency assets, which also provides USDT to fiat conversion services. According to Nexo’s website, the conversion fee is 1.5%. The platform emphasizes security, offering insurance for assets up to $375 million and using modern data protection methods. Transactions are processed quickly, often instantly. Nexo is available to users worldwide, except in countries with specific legal restrictions. The platform’s reputation is bolstered by its transparent policies and high-security standards, making it an attractive option for new users.

These platforms offer various options for converting USDT to fiat currencies, each with its own advantages and features. When choosing the right platform, it is essential to consider the aforementioned criteria to ensure a safe and advantageous conversion of cryptocurrency assets. It is also important to note that the waiting time for funds to be credited from crypto to fiat on virtual cards of these services can exceed 24 hours.

What Are the Advantages of Using Virtual USDT Cards for Fiat Conversion?

Using virtual USDT cards to convert cryptocurrency to fiat offers several key advantages, making them an attractive option for many users. We have reviewed various financial services offering virtual cards, and we can identify common key benefits for crypto-to-fiat conversion.

-

Convenience and Ease of Use

Virtual USDT cards provide a straightforward and user-friendly method for converting crypto to fiat. These cards can be easily managed through online platforms and mobile applications, allowing users to handle their transactions from anywhere at any time.

-

Security and Data Protection

Security is a paramount concern when dealing with cryptocurrencies.

Virtual USDT cards offer robust security measures to protect users’ assets and personal information. Platforms such as PSTNET, Bybit, and Capitalist employ advanced encryption technologies, two-factor authentication (2FA), and cold storage solutions to ensure the highest level of security.

-

Speed and Efficiency of Transactions

One of the significant benefits of virtual USDT cards is the speed at which transactions can be processed. These cards allow for quick conversion of USDT to fiat, often completing transactions within minutes. PSTNET is known for their efficient processing times, enabling users to access their fiat funds immediately.

-

Global Accessibility

Virtual USDT cards offer the advantage of being accessible from virtually anywhere in the world. This global reach is particularly beneficial for users who travel frequently or live in regions with limited access to traditional banking services.

How to Choose the Right Platform or Service?

When selecting a platform or service for converting USDT to fiat using virtual cards, consider the following factors:

- Review the fee structures of various platforms. In addition to the conversion fees, it is crucial to examine limits and restrictions. Make sure to account for card top-up fees, transaction fees, and any hidden charges. Preference should be given to platforms with transparent fee structures to avoid unexpected costs.

- Evaluate the processing times. Some platforms offer near-instant transactions, while others may take longer.

- Ensure the platform employs robust security measures. Look for features like two-factor authentication (2FA), advanced encryption, and cold storage.

- Ensure the card integrates well with traditional banking systems for seamless fiat transactions. Cards offered by platforms like PSTNET and Capitalist are connected to Visa and Mastercard networks, providing broad usability.

- Confirm the platform’s availability in your region. Some services may have regional restrictions, so it’s crucial to verify that the platform operates in your location.

How Can You Minimize Fees and Processing Time?

Choose Cards with Instant Conversion

Selecting virtual cards that offer instant conversion from USDT to fiat can save you considerable time. Services like PSTNET are known for their real-time transaction capabilities, ensuring that your funds are available almost immediately after conversion.

Read User Feedback

Before committing to a platform, take the time to read user feedback. Feedback from other users can provide valuable insights into the platform’s fee structure, transaction speed, and overall reliability. Websites like Trustpilot and Reddit are good sources for user experiences and feedback.

Use the most efficient methods for topping up your card

Some platforms may offer lower fees for certain top-up methods or faster processing times for others.

For example, using cryptocurrencies directly might be quicker and cheaper than traditional bank transfers.

Monitor Network Congestion

Cryptocurrency transactions can be delayed due to network congestion. To avoid long waiting times, consider making transactions during off-peak hours. Monitoring network conditions can help you choose the best time for transactions.

Utilize Customer Support

If you encounter delays or issues, promptly contact customer support. Quick resolution can help minimize downtime and ensure smoother transactions.

To Sum Up

Virtual USDT cards provide a streamlined solution for converting cryptocurrency to fiat currency. They stand out for their ease of use, allowing users to manage transactions effortlessly through online platforms and mobile applications. These cards are equipped with advanced security features, such as encryption and two-factor authentication, ensuring that users’ assets and personal information remain protected.

The speed and efficiency of transactions are significant advantages, with many platforms offering near-instant conversion of USDT to fiat. This rapid processing allows users to access their funds quickly, facilitating smoother financial operations. Additionally, the global accessibility of virtual USDT cards makes them ideal for users who travel frequently or reside in areas with limited access to traditional banking services.

Choosing the right platform or service is crucial. Factors such as fee structures, processing times, security measures, and regional availability should be carefully evaluated. Platforms like PSTNET, Bybit, and Capitalist offer competitive features, broad usability through Visa and Mastercard networks, and strong security protocols.

We hope our tips have been helpful.

Choose your crypto card and unlock the easiest way to convert USDT to fiat!

The outcome is displayed on-screen, and any winnings are credited to your account instantly.

The outcome is displayed on-screen, and any winnings are credited to your account instantly.