Economic uncertainty can create significant challenges for investors and savers alike. From market volatility and inflation to unexpected global events, safeguarding your wealth requires strategic planning and a diversified approach. While it’s essential to focus on traditional investment avenues, exploring alternative options such as an online casino can offer some entertainment and potential financial benefits in a controlled manner.

Diversify Your Investments

Spread Your Risk

One of the fundamental principles of protecting your wealth is diversification. By spreading your investments across different asset classes, such as stocks, bonds, real estate, and commodities, you can mitigate the risk of a significant loss in any one area. Diversification helps balance your portfolio, ensuring that the performance of one asset class can offset the poor performance of another.

Consider Defensive Stocks

Defensive stocks are those of companies that provide essential goods and services, such as utilities, healthcare, and consumer staples. These stocks tend to be more stable and less affected by economic downturns, making them a reliable choice during uncertain times. Investing in defensive stocks can help preserve your wealth by providing steady returns even when the market is volatile.

Build an Emergency Fund

Maintain Liquidity

Having a readily accessible emergency fund is crucial during periods of economic uncertainty. This fund should cover at least three to six months’ worth of living expenses. Keeping this money in a high-yield savings account ensures that you have liquidity to meet unexpected expenses or take advantage of investment opportunities without having to sell off other investments at a loss.

Reduce Debt

Managing and reducing debt is another key strategy for protecting your wealth. High-interest debt can erode your financial stability, especially during economic downturns when income may be uncertain. Prioritize paying down credit cards, personal loans, and other high-interest debts to improve your financial resilience.

Explore Alternative Investments

Real Estate

Real estate can be a valuable addition to your investment portfolio. Property values tend to appreciate over time, and rental income can provide a steady cash flow.

Consider investing in residential, commercial, or even agricultural properties to diversify your assets further.

Precious Metals

Investing in precious metals like gold and silver can act as a hedge against inflation and market volatility. These assets have intrinsic value and are often seen as a safe haven during economic uncertainty. Adding a small percentage of precious metals to your portfolio can provide an extra layer of protection.

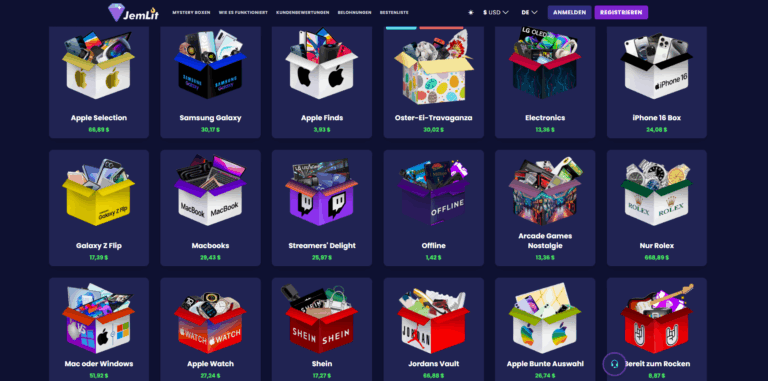

Online Casinos

Interestingly, some investors explore unconventional options like an online casino for entertainment and potential financial gains. While this should not be a primary investment strategy, engaging in responsible gaming can offer a distraction from market stress and, in some cases, yield monetary rewards. Always approach this with caution, setting strict limits to ensure it remains a fun and controlled activity.

Stay Informed and Flexible

Keep Up with Market Trends

Staying informed about economic trends and market developments is crucial for making informed investment decisions. Subscribe to financial news, follow market analysts, and consider consulting a financial advisor to stay ahead of potential changes that could impact your wealth.

Rebalance Your Portfolio

Regularly reviewing and rebalancing your portfolio ensures that your asset allocation remains aligned with your financial goals and risk tolerance. Economic conditions can change rapidly, and rebalancing allows you to adjust your investments to maintain the desired level of diversification and risk management.

Focus on Long-Term Goals

Avoid Panic Selling

Market downturns can trigger fear and anxiety, leading some investors to sell off assets at a loss. It’s important to stay focused on your long-term financial goals and avoid making impulsive decisions based on short-term market fluctuations.

Historically, markets tend to recover over time, and staying invested can help you benefit from eventual rebounds.

Continue Investing

Regular investing, even during periods of economic uncertainty, can help you take advantage of lower asset prices and dollar-cost averaging. Consistently contributing to your investment accounts, such as retirement funds or individual investment portfolios, ensures that you continue building wealth regardless of market conditions.

Conclusion

Protecting your wealth during economic uncertainty requires a multifaceted approach. Diversifying your investments, building an emergency fund, exploring alternative investments, and staying informed are all crucial steps in safeguarding your financial future. While traditional strategies form the backbone of wealth protection, incorporating unconventional methods for controlled entertainment can provide a balanced approach to managing stress and maintaining financial stability. By remaining vigilant and proactive, you can navigate economic uncertainty with confidence and resilience.