Volkswagen, the largest automaker in the world, has been embroiled in an emissions cheating scandal that is likely to cost the company billions of dollars. The news sent Volkswagen’s stock prices plunging and investors are wondering if now is a good time to buy Volkswagen stocks. While the future of Volkswagen is uncertain, there are several reasons why buying Volkswagen stocks may be a good investment.

What is Volkswagen’s Stock

In the US, Volkswagen’s stock is traded on the over-the-counter (OTC) market. The OTC market is a decentralized market where stocks are not traded on a formal exchange like the New York Stock Exchange (NYSE). In the UK, Volkswagen’s stock is traded on the London Stock Exchange (LSE). In Australia, Volkswagen’s stock is traded on the Australian Securities Exchange (ASX). In Germany, Volkswagen’s stock is traded on the Frankfurt Stock Exchange (FSE).

how to buy volkswagen stocks

If you’re interested in buying Volkswagen stocks, you’ll need to open an account with a broker that offers OTC stocks. In the US, some popular brokers that offer OTC stocks include TD Ameritrade, E-Trade, and Robinhood. In the UK, popular brokers include Hargreaves Lansdown and Barclays Stockbrokers. In Australia, popular brokers include CommSec and CMC Markets. In Germany, popular brokers include Comdirect and Consorsbank.

What is Volkswagen’s Stock Price

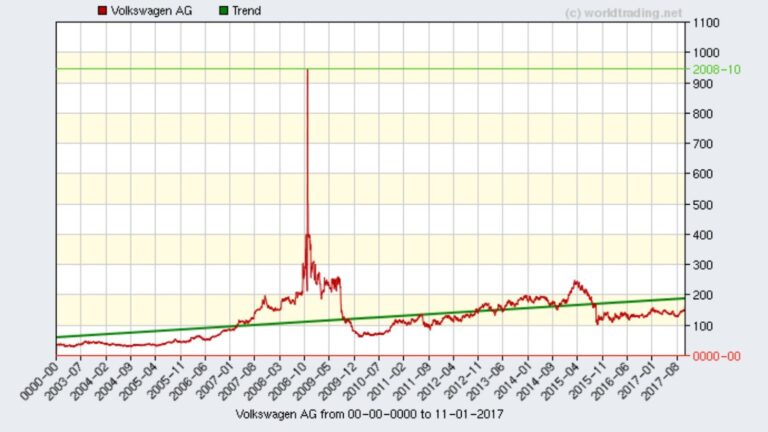

Volkswagen’s stock price has been volatile in recent months due to the emissions scandal. In the US, Volkswagen’s stock was trading at around $30 per share in September of 2015. By October of 2015, Volkswagen’s stock had plummeted to around $20 per share. As of February of 2016, Volkswagen’s stock price had recovered somewhat and was trading at around $25 per share.

In the UK, Volkswagen’s stock was trading at around £18 per share in September of 2015. By October of 2015, Volkswagen’s stock had plummeted to around £12 per share. As of February of 2016, Volkswagen’s stock price had recovered somewhat and was trading at around £14 per share.

In Australia, Volkswagen’s stock was trading at around A$40 per share in September of 2015. By October of 2015, Volkswagen’s stock had plummeted to around A$28 per share. As of February of 2016, Volkswagen’s stock price had recovered somewhat and was trading at around A$32 per share.

In Germany, Volkswagen’s stock was trading at around €23 per share in September of 2015. By October of 2015, Volkswagen’s stock had plummeted to around €16 per share. As of February of 2016, Volkswagen’s stock price had recovered somewhat and was trading at around €19 per share.

Why buy Volkswagen Stocks

Despite the emissions scandal, there are several reasons why buying Volkswagen stocks may be a good investment. First, Volkswagen is the largest automaker in the world and has a strong presence in emerging markets. Second, Volkswagen has a strong brand and is likely to weather the emissions scandal. Third, Volkswagen’s stock price has been volatile in recent months and may continue to be volatile in the future. As such, there may be opportunities to buy Volkswagen stocks at a discount.

Volkswagen is the largest automaker in the world

As of 2015, Volkswagen Group is the largest automaker in the world with sales of over 10 million vehicles. Volkswagen Group consists of 12 brands including Audi, Bentley, Bugatti, Ducati, Lamborghini, Porsche, SEAT, Skoda, and Volkswagen. In 2015, Volkswagen Group sold over 5.8 million vehicles in China, making it the largest market for Volkswagen Group.

Volkswagen has a strong presence in emerging markets

Volkswagen has a strong presence in several key emerging markets including Brazil, China, India, Russia, and South Africa. In 2015, Volkswagen Group sold over 5.8 million vehicles in China, making it the largest market for Volkswagen Group. In Brazil, Volkswagen is the second largest automaker with a market share of around 17%. In India, Volkswagen is the fourth largest automaker with a market share of around 2%.