Welcome to Crypto Trading 101! In this guide, we’ll cover the basics of cryptocurrency trading. We’ll discuss what cryptocurrency is, how it works, and some of the key terminology you need to know. We’ll also provide an overview of the different types of exchanges available, and give you a step-by-step process for getting started with trading. Cryptocurrency is a digital or virtual asset that uses cryptography for security. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Are you curious about Bitcoin but unsure of where to start? You’re in the right place! Bitcoin for beginners provide an overview of what Bitcoin is, how to use it and the opportunities it can offer.

Cryptocurrencies are often traded on decentralized exchanges, which are platforms that allow for peer-to-peer trading. Decentralized exchanges are not subject to government regulation, and can offer more privacy than traditional exchanges. If you’re interested in trading cryptocurrency, there are a few things you need to know. First, you’ll need to choose a cryptocurrency exchange. There are many different exchanges available, so it’s important to do your research before selecting one. Once you’ve chosen an exchange, you’ll need to create an account and deposit funds. Once your account is funded, you can start trading!

What Does Bullish Mean in Crypto

Bullish is used to describe an upward trend in the market. It can also refer to an individual who believes that the market will rise. When a trader is bullish, they may open long positions in order to profit from the expected price increase. Bullishness is often associated with increased buying activity in the market.

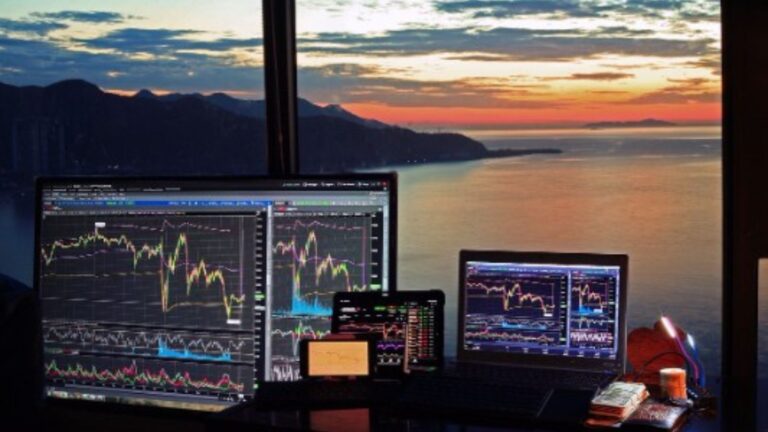

What is Crypto Trading and How Does it Work?

Crypto trading is the process of buying and selling cryptocurrencies on exchanges. Cryptocurrencies are digital or virtual assets that use cryptography for security. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

Cryptocurrency trading is similar to forex trading in that it involves buying and selling currencies. However, there are some key differences. First, unlike forex, there is no central authority regulating cryptocurrency trading. This means that prices can fluctuate greatly from one exchange to another. Second, crypto trading is typically done on decentralized exchanges, which are platforms that allow for peer-to-peer trading. Decentralized exchanges are not subject to government regulation, and can offer more privacy than traditional exchanges.

The Benefits of Crypto Trading

Crypto trading has a number of benefits. First, it offers a high degree of privacy. Unlike traditional exchanges, which are subject to government regulation, decentralized exchanges are not subject to the same level of scrutiny. This means that your trades can be more private. Second, crypto trading can be done 24/7. Traditional markets typically have set hours, but the decentralized nature of crypto means that trading can take place around the clock. Finally, crypto trading can be more volatile than traditional markets.

This means that there is the potential for greater profits, but also greater losses.

How to Get Started With Crypto Trading

If you’re interested in trading cryptocurrency, there are a few things you need to know. First, you’ll need to choose a cryptocurrency exchange. There are many different exchanges available, so it’s important to do your research before selecting one. Once you’ve chosen an exchange, you’ll need to create an account and deposit funds.