In recent years, cryptocurrencies have become increasingly popular investments. Bitcoin, the first and most well-known cryptocurrency, has seen its value grow tremendously.

However, there are many other cryptocurrencies out there that offer compelling investment opportunities as well. One of these is etherum.

What is Ethereum and why should you invest in it today

Ethereum is a decentralized platform that runs smart contracts: applications that run exactly as programmed without any possibility of fraud or third party interference.

Ethereum is the second most popular cryptocurrency after Bitcoin, and it has experienced even faster growth than Bitcoin. In fact, Ethereum’s market capitalization is now larger than Bitcoin’s, although Bitcoin still has a higher individual price. Investing in Ethereum today offers investors the potential for high returns. Ethereum’s price has grown exponentially in recent months, and it is expected to continue to grow as more and more people adopt it.

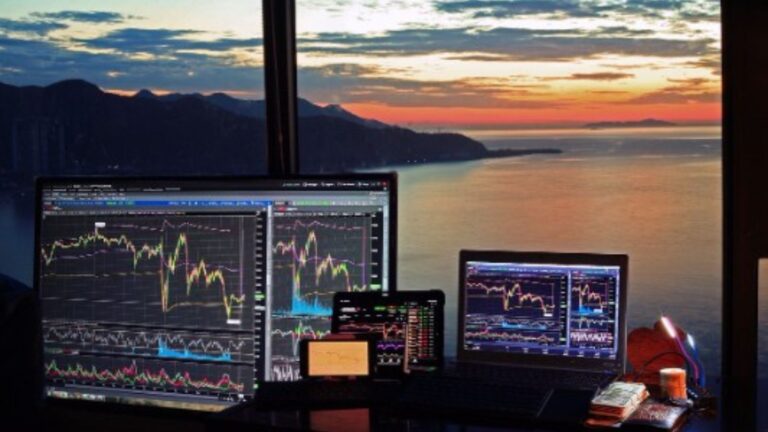

How to buy Ethereum

Investing in Ethereum is relatively simple. The first step is to set up a wallet to store your ether. There are many different wallets available, but we recommend using MetaMask. MetaMask is a browser extension that allows you to store and use Ethereum without having to download any extra software. Once you have a wallet set up, you can buy Ethereum on an exchange. We recommend using Coinbase, as it is one of the most popular and user-friendly exchanges.

Coinbase allows you to buy Ethereum with a credit or debit card, or with a bank transfer. Once you have purchased Ethereum, you can store it in your MetaMask wallet or in another wallet of your choice.

What are the potential risks and rewards of investing in Ethereum

Like any investment, there are risks involved in investing in Ethereum. The price of Ethereum is highly volatile and could drop sharply at any time. However, Ethereum also has the potential for high returns. Some investors believe that Ethereum will eventually supplant Bitcoin as the world’s leading cryptocurrency. If this happens, the value of Ethereum could rise dramatically. Of course, it is also possible that Ethereum will never achieve widespread adoption and its price will remain relatively low. Investors should be aware of these risks before investing in Ethereum.

At the same time, there are also potential rewards to investing in Ethereum. As more and more people adopt Ethereum, its price is likely to continue to rise. Ethereum is already the second most valuable cryptocurrency after Bitcoin, and it has the potential to grow even larger. Investors who are considering investing in Ethereum should do their own research and consult with a financial advisor to make sure that they are comfortable with the risks involved.

when will ethereum hit 10000

Ethereum could have several catalysts that could enable it to reach 10,000 in 2022. The first is the launch of ETH 2.0, which is scheduled to occur in mid-2022. ETH 2.0 is a major upgrade to the Ethereum network that will improve its scalability and performance. This upgrade is expected to increase demand for Ethereum, driving up its price.

Another potential catalyst for Ethereum’s price is the increasing adoption of DeFi (decentralized finance). DeFi is a new category of financial applications that are built on Ethereum. These applications are designed to provide alternatives to traditional financial products and services. As more people use DeFi applications, demand for Ethereum is likely to increase, driving up its price. Finally, another potential catalyst for Ethereum’s price is the increasing institutional interest in cryptocurrency.

Tips for buying, selling, and trading Ethereum in the future

If you’re thinking about buying Ethereum, there are a few things you should keep in mind. First, don’t invest more than you can afford to lose. The price of Ethereum is volatile, and it could drop sharply at any time. Second, consider using a stop-loss order to protect your investment.

A stop-loss order is an order to sell Ethereum if it falls below a certain price. This can help you limit your losses if the price of Ethereum drops. Finally, don’t forget to diversify your investments. Ethereum is just one part of a broader investment portfolio. Don’t put all of your eggs in one basket.